2022 tax return calculator canada

Use our free 2022 Canada income tax calculator to see how much you will pay in taxes. That means that your net pay will be 37957 per year or 3163 per month.

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

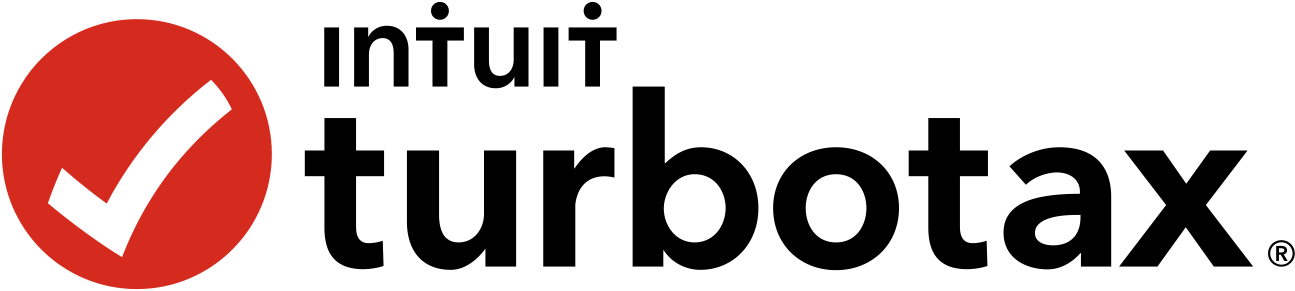

You can also explore Canadian federal tax brackets provincial tax brackets and Canadas federal and.

. 2022 free British Columbia income tax calculator to quickly estimate your provincial taxes. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. You can also create your new 2022 W-4 at the end of the tool on the tax.

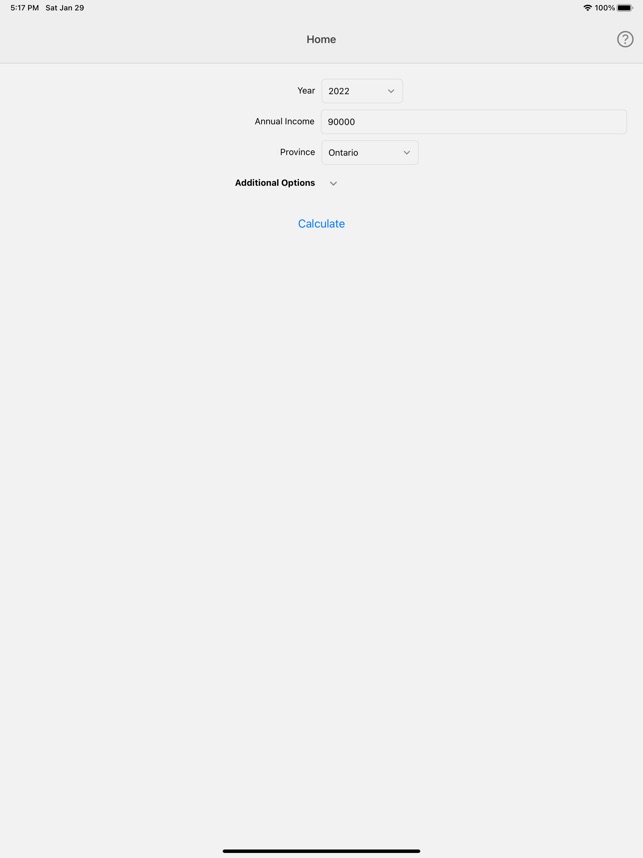

It all adds up to The New. The Canadian Tax calculator calulates provincial and Federal tax and provides full tax calculations based on the latest Canadian tax rates for 20222023 tax year. Calculate the tax savings your RRSP contribution generates in each province and territory.

2022 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory. 2021 2022 tax brackets and most tax. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions.

Below there is simple income tax calculator for every Canadian province and territory. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. The canada tax calculator provides state and province tax return.

This handy tool allows you to instantly find out how much Canadian tax back you are owed. This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available. The best starting point is to use the Canadian tax refund calculator below.

In Canada each province and territory has its own provincial income tax rates besides federal tax rates. 2022 Tax Return Calculator Canada. 2022 Tax Calculator Select your province Employment income Self-employment income Other income CRB EI CPPOAS Capital gains Eligible dividends Ineligible dividends.

We are a community of solvers combining human ingenuity experience and technology innovation to deliver sustained outcomes and build trust. After 11302022 TurboTax Live Full Service customers will be able to amend their. Use our free 2022 ontario income tax calculator to see how much you will pay in taxes.

The calculator reflects known rates as of June 1 2022. July 22 2022 WOWA Trusted and Transparent Estimate your income taxes by providing a few details about yourself and your. Calculations are based on rates known as of June 17 2022 including federal and provincialterritorial tax changes known at this time.

Assumes RRSP contribution amount is fully. This Pages Content Was Last Updated. Reflects known rates as of June 1 2022.

Claims must be submitted within sixty 60 days of your TurboTax filing date no later than May 31 2022 TurboTax Home Business and TurboTax 20 Returns no later than July 15 2022. Your average tax rate is.

Personal Income Tax Brackets Ontario 2021 Md Tax

Tax Season 2021 New Income Tax Rates Brackets And The Most Important Irs Forms

Feb 7 Adult 50 Free Tax Preparation Aid 2022 Los Altos Los Altos Ca Patch

Crypto Com Tax The Best Free Crypto Tax Bitcoin Tax Calculator

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Turbotax Taxcaster 2022 2023 Free Tax Refund Calculator

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Tax Calculator Return Refund Estimator 2022 2023 H R Block

How Does A Tax Refund Work In Canada Nerdwallet Canada

2022 Canada Income Tax Calculator Turbotax Canada

2022 Income Tax Calculator Canada

Income Tax Calculator Calculatorscanada Ca

Form 1116 Step By Step Guide To Claim The Foreign Tax Credit

Federal Income Tax Return Calculator Nerdwallet

Child Tax Credit 2021 2022 What To Know This Year And How To Claim Your Refund Wsj

Marginal Tax Vs Average Tax Understanding Canadian Tax Brackets